It was the end of the month, and I had no idea where all my money went! It was like I was running out of money before I was running out of month. Are you wondering how to manage your money, just like I was a while back?

Get ready because I’m going to teach you how to make a monthly budget in a way that’s SIMPLE.

You’ll see the benefits and get action steps to make it happen so you can be more financially in charge! You’ll see how this will allow you to better manage your money and save to work toward financial freedom.

This post may contain affiliate links which means I’ll receive a commission if you purchase through my links, at no extra cost to you. Please read full disclosure for more information.

How to Make a Monthly Budget

First of all, a monthly budget is simply a list with categories/line items and a suggested amount you spend in each.

You’ll log/track your income, expenses, and savings.

As soon as you purchase something, log it in your budget under the correct category.

The idea is for your expenses to be less than your income. What’s leftover goes toward savings.

Every Dollar App

I personally use and LOVE the Every Dollar App. It’s free and so straightforward.

It comes with preloaded categories, but you can customize it completely to your lifestyle. My husband and I added a “pet” category and a “movies” category because those are things we regularly spend money on.

You can always go the pen-and-paper route with a physical budgeting planner too.

Reminder: A budget doesn’t tell you HOW to spend your money. Your budget should reflect the areas you spend money in regularly. A budget serves simply as a guide for your spending. It doesn’t have to limit your spending to only necessities.

Related reading: Live Fully Today- There’s a HUGE Perk!

If you like to go out for ice cream, budget that in! Your budget should set you free, not limit you.

(I’m a big advocate of doing things you enjoy! And your budget shouldn’t stop you! It should work with you and your lifestyle. I’m a big believer in self-care, as I believe it contributes to your overall wellness (of which financial wellness is a part of) in a big way!

If you want to set financial goals, I’ve already written about exactly how to set and achieve goals! Plus I created an action plan for you to map out your exact steps toward your goal!

Here’s How the Every Dollar Budget App Works

Log every purchase you make (or set up the app so it’s connected to your debit card- the app will automatically log and keep track of purchases for you).

It sounds annoying to log everything, but…

- It only takes a few seconds and a little discipline to set the habit.

- It causes you to think twice before spending, making you a more conscious consumer and wiser with your money.

Try to keep your spending in each category within the limit you set. If you see that you’ve already spent all of the $150 you’ve budgeted for eating out, choose to stay in for the rest of the month to stay within your budget.

Maybe you’ve spent all the money in your “coffee shops” budget, so instead of buying that delectable scone, you stay home and make a healthy tasty treat instead.

It’s not about denying yourself anything! It’s also about shifting your perspective. It’s just about making smarter moves with your money.

Note: It’s okay to go over budget sometimes! Be flexible.

If your niece is having a birthday dinner you don’t want to miss, don’t let the fact that you’re at your restaurant limit for the month stop you from going. This is why you have a bonus category like “fun money” or “misc.”

However, there may be a time when you’ll have to say no to a week-long girls trip to Cabo or skip the front row tickets for that concert to meet your savings goals and stay on track.

And for those times, it’s about managing your expectations to avoid disappointment.

Budgeting Tip

Keep in mind that it takes a few months of logging your expenses and purchases to get a good idea of what you should be budgeting for each category.

Example: If you’re new to budgeting and start off budgeting $200 for groceries for one month, but for 3 months in a row, you see you’re spending $450 on groceries, it’s time to adjust your budget.

In the beginning, you won’t know exactly how much is appropriate to budget for each category or what fits your lifestyle. Allow yourself a few months to get a good idea of what’s realistic for each category.

Budget Categories

Here are my personal categories within my budget:

Income

- Paycheck 1 and 2 (me)

- Paycheck 1 and 2 (my husband)

Giving

- Church

Savings

- Vacation

- General savings

Housing

- Electricity

- Mortgage

Transportation

- Gas

- Tolls

- Maintenance (We use this only every few months for oil changes and such.)

Food

- Groceries

- Restaurants

Personal

- Movies

- Clothing (We don’t use this every month, but keep it in there just in case.)

- Phone

- Fun money (It’s important to allow yourself to spend a little money on things you want and enjoy!)

- Subscriptions

- Coffee shops

- Internet

Lifestyle

- Pets

- Miscellaneous (This one is key, make sure you include it. There are always a few extra things you will have forgotten to account for when you make your budget at the beginning of the month- things always come up!)

- Gifts

- Caleb’s fund (We each have a set amount of money to spend where we want.)

- Skye’s fund (here are some of my favorite products!)

- House items (This category is newer, and may only be for a season since we are new homeowners.)

- Virginia Trip (This category was only for one month. Plan ahead for unique expenses so you’re not caught off guard.)

Health

- Medicine/Vitamins

- Doctor visits

Insurance

- Health insurance

- Life insurance

- Auto insurance

- Roth IRA

Debt

- Credit card

Other categories that are not on every month’s budget, but maybe only a few times a year are things like the water bill or oil (since we have oil heat and don’t pay for this monthly).

See how your budget can change from month to month? It should flex with your life.

If you have a trip planned and want to start saving months in advance, add it in as a line item. Or maybe you have a big month of birthdays and need to add extra money into the “gifts” category.

It’s okay for the amount you budget for each category to change, in fact, it’s good!

Some months, you’ll spend less on certain things, and much more on others. You’ll notice changes with the seasons too. It’s all normal!

The goal isn’t to have your budget be exact and the same each month. The goal is for you to stick as closely to the amount you budget for each category and know where your money is going.

Note: Having a budget gives you permission to spend money wisely!

Plus, having a budget helps you to feel a heck of a lot more organized as you try and do this whole adulting thing. Organizing every aspect of your life can seriously reduce stress!

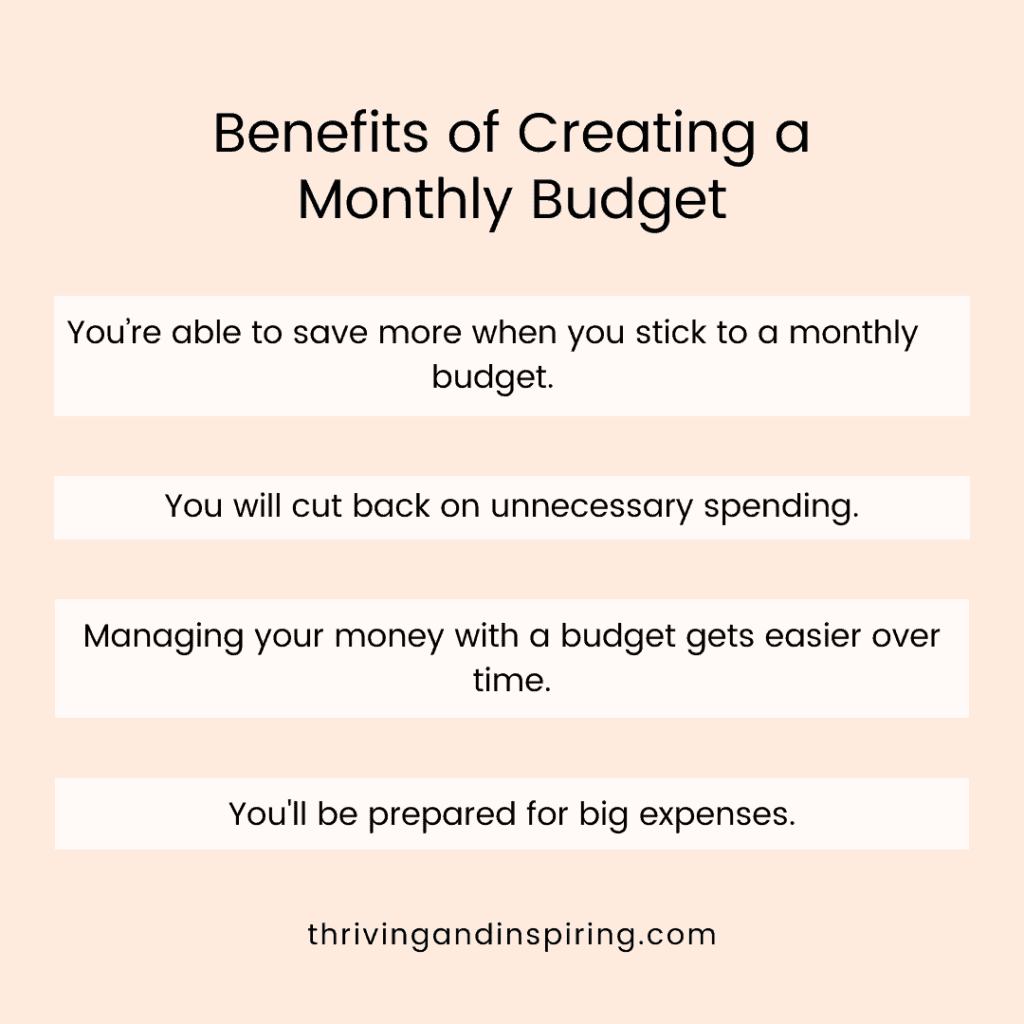

Benefits of Creating and Sticking to a Monthly Budget

You’re Able to Save More When You Stick to a Monthly Budget

When you’ve nailed down exactly what your expenses and spending add up to, and you’re logging everything, you’ll be spending more wisely.

And when you can stick to a budget and not go over for each of the categories, you’ll find you have more money left at the end of the month than when you weren’t using a budget. All that extra money can go into savings.

Plus, when you have a savings line item in your budget, and you are able to see exactly how much you can put away, it’s incredibly satisfying and ends up being an incentive to save even more. It becomes like a game to see how much you can sock away each month.

You Will Cut Back on Unnecessary Spending

When you have to keep track of your purchases, you’ll find you’re less likely to spring for the $6 latte. Maybe you’ll choose the $2 drip coffee instead.

If you want to buy new patio cushions or a fancy new kitchen faucet (I finally got one!), but see you’re already at the top of your miscellaneous budget for the month, maybe you choose to wait on those unnecessary things.

Just until you have the room in your budget to buy them comfortably so you’re not sacrificing money going to savings or causing yourself to go over budget.

Managing Your Money With a Budget Gets Easier Over Time

Once you’ve set one up (try using the Every Dollar app or another app so it’s always at your fingertips), it’s very easy to maintain because many of your expenses are fixed (mortgage, phone, internet).

And the variable expenses like gas, electric, and eating out will be easier to guestimate because you have a good idea of what you’ve spent in those categories over the past few months.

You’ll Be Prepared for Big Expenses

If you’re wondering how to manage your money when big things come up, a budget is your answer.

When you make your budget each month, look ahead to the events in that month like holidays, trips, and birthdays. Then you’ll allot a chunk of money to those things so they don’t blindside you.

Action Steps and Reminders for Creating a Budget and Managing Your Money

Reminder: Every Dollar has a Job

This is the idea of a zero-based budget. Every dollar that comes in is accounted for. Meaning, there’s no leftover money.

Each dollar you make in income is assigned to an expense, purchase, or savings account. This way you know where ALL of your money is going. You’ll feel more financially confident and in control if you assign every dollar a job.

Action Step: Set Up Monthly Money Meetings

If you’re wondering how to manage your money and actually stick to a budget, the key is to set up your budget at the beginning of every month.

Maybe this means you sit down for a few minutes on the last day of the month, or the first day of the next month and set up your budget. Have a little budgeting party. Get your favorite snack or drink, put some music on, and make it pleasurable!

Plus, it doesn’t take long once you have an idea of what your expenses are.

Action Steps in Order:

I’m a fan of making things super simple, so here’s exactly how to manage your money and make a monthly budget:

- Download a budgeting app.

- Check your bank account for your last month’s paychecks and enter them in the “income” section of the app. Add in any other income.

- Customize the categories to fit your life. You’ll find you’ll end up adding more in later. The basics are good for now.

- Fill in an estimate of how much you think you will spend/would like to spend in each category. If it helps, look back at your bank account to get an idea of past purchases.

- Log your expenses moving forward. Every single thing you buy.

- Be sure to put whatever’s left over in savings (not just in the app, but actually transfer that money over when it’s time)!

- Create a new budget each month, adjusting the budgeted amounts for categories as you go and get a better idea of how much you spend in each area.

- In 3 months, reassess your budgeted amounts. Make it the average of the past 3 months. (If you spend $400 on groceries in month 1, $350 in month 2, and $425 in month 3, your average is about $390. Make this your new budget for groceries.)

Let’s Bring it Home

If you feel like you don’t know where your money goes each month or like you’re unable to save any money for the future, I hope you feel a little bit more at ease now that you know how to make a monthly budget and how to manage your money. Turns out, it’s really not that complicated!

It’s just all about understanding what your expenses are and setting appropriate spending limits for yourself. Plus, you can do it all through a free app! Once you make a monthly budget and stick to it, you’ll be able to better manage your money and work toward financial freedom!

Related Reading

Exactly What to do When You’re Feeling Behind in Life

6 Must-Have Tips to Find Balance in Your Life and Manage All Your Responsibilities

7 Tips for Becoming More Independent + 16 Activities to Become a Strong Independent Woman

Share this post with someone who could benefit from it!

And follow me on Pinterest for encouraging graphics!

Thank you for the great tips. I have become a lot better with budgeting over time but could use some tweaks. I definitely like the Every dollar app with a zero based budget idea.

Yes, it absolutely takes time! And the zero-based budget is my favorite because it’s simple and easy to follow!

great ideas for having a budget

Thanks, Jimmy! I hope they help!

These are great tips! And even better still, your suggestions are realistic so it’s easier to stick with a budget. I love that you specifically budget for fun money as well as money that you and your husband can each spend as you wish. These are important items that I think most of us miss and/or aren’t honest about needing when initially making a budget. I’ll also be checking out the app you suggested. Thank you for sharing!

I’m so glad you feel the same way about the fun money and individual “me” funds! It really makes budgeting so much more palatable 🙂

Very helpful! I didn’t know about the Every Dollar App. This motivates me to get back to budgeting better.

This app seriously makes it so simple! Be patient with yourself in the beginning as it takes a few months to understand your spending habits.

These tips are so true. Budgeting has become essential for us to track where our money is going and pay off debt. In fact, we have paid of huge amounts of debt by making sure that our extra pennies here and there are going towards debt instead of treating ourselves too much.

That being said, one of the most important things about budgeting I have learned is that it is okay to have a little bit of leeway. It is just too hard to say no to eating out EVER, or never allowing ourselves to have fun money. We just have to plan for it! Its a mindset!

I totally agree that absolutes, like trying to “never eat out again” to save money, is not sustainable at all. You are right that leeway is necessary 🙂

I love the comment about budgeting shifting your perspective. My husband and I budget. It makes it easy to be on the same page knowing our financial goals and getting all of the debt paid off.

Yes! Budgeting as a couple takes things to a whole other level, it’s so helpful if you can be on the same page 🙂

Great tips and idea, I found the article very helpful.Thanks for sharing

Glad you found this post so helpful 🙂

I am a very organized person, but I don’t think I keep enough tabs on my money. Didn’t know there was an app called Every Dollar. Might check it out. Thank you for this lovely post!

Yes! I hope you find the app useful! It truly makes budgeting SO easy!

This is such an inspiring post to get a better handle on managing money and finally start a budget. This is especially true with inflation and the holidays approaching. Thank you for sharing such great ideas!

Couldn’t agree more that this time of year really calls for a budget 🙂

Wow this is such a brilliant post jam packed with advice and tips. I also love your mindset with money budgeting and love how you say it should set you free. I couldn’t agree more and I think it’s a really empowering way to think about it.

Absolutely! And there’s really nothing better than feeling empowered! We become unstoppable when we feel empowered 🙂

Like most countries, the UK is having a cost of living crisis and many of us are more aware of our spending and need to budget. So these tips are very timely!

I’m thrilled these tips came at a good time for you! 🙂 I know they will serve you well!

Such helpful budgeting tips – thank you. I’ve recently found that with fuel prices going up, so do grocery prices, so it’s so important to be on top of the budget every month.

Totally agree, Chantal. Prices have been crazy, so it’s a better time than ever to create and stick to a budget that makes sense for you! 🙂

Thank you for these tips. I love what you wrote: Your budget should set you free, not limit you. I totally agree. Thanks again.

Thanks for your kind words, Christine! Yes, a budget isn’t meant to hold you back in the least bit!